Investors and analysts are also becoming increasingly interested in young players such as Galaxy Health Insurance that have recently entered the market in India. As the market for health insurance grows in India, possible targets for the share price of Galaxy Health Insurance Company Limited for 2025 to 2030 are relevant for investors. This article examines the factors determining the companys growth and predicts the target share prices for the future years.

Market Overview

Indian Health insurance market is in the growing phase due to high middle income group population, increase in health consciousness, expansive growth in the number of health care centers. This crisis has brought out the need to have health insurance and as a result, insurance policies have been bought massively. This is a good indication to health insurance companies and Galaxy Health Insurance inclusive of it.

Factors Influencing Share Price

Several factors will influence Galaxy Health Insurance’s share price in the upcoming years:

- Market Positioning and Product Offerings: Galaxy Health Insurance is positioning itself as a customer-centric company, focusing on innovative products and services tailored to meet diverse customer needs. The introduction of new health insurance plans, which cater to a wider audience, can enhance the company’s market share and, in turn, its stock price.

- Regulatory Environment: The insurance sector in India is regulated by the Insurance Regulatory and Development Authority of India (IRDAI). The regulatory framework can impact operational aspects, pricing strategies, and profit margins. Any favorable regulatory changes, such as incentives for insurance companies or relaxed norms for new product launches, could positively impact share prices.

- Financial Performance: Investors closely monitor financial indicators such as revenue growth, profitability margins, and claims ratios. Galaxy Health Insurance’s ability to maintain a healthy claims ratio while growing its premium collection will be crucial. Positive quarterly and annual results are likely to boost investor confidence and lead to an upward trend in share prices.

- Economic Conditions: The broader economic environment, including GDP growth rates, employment levels, and consumer spending power, can significantly impact the insurance sector. A growing economy tends to increase disposable incomes, leading to higher insurance uptake.

- Technological Advancements: The adoption of technology in underwriting, claim processing, and customer service enhances operational efficiency. Galaxy Health Insurance’s investment in digital platforms can lead to cost savings and better customer experiences, positively influencing its share price.

Share Price Predictions

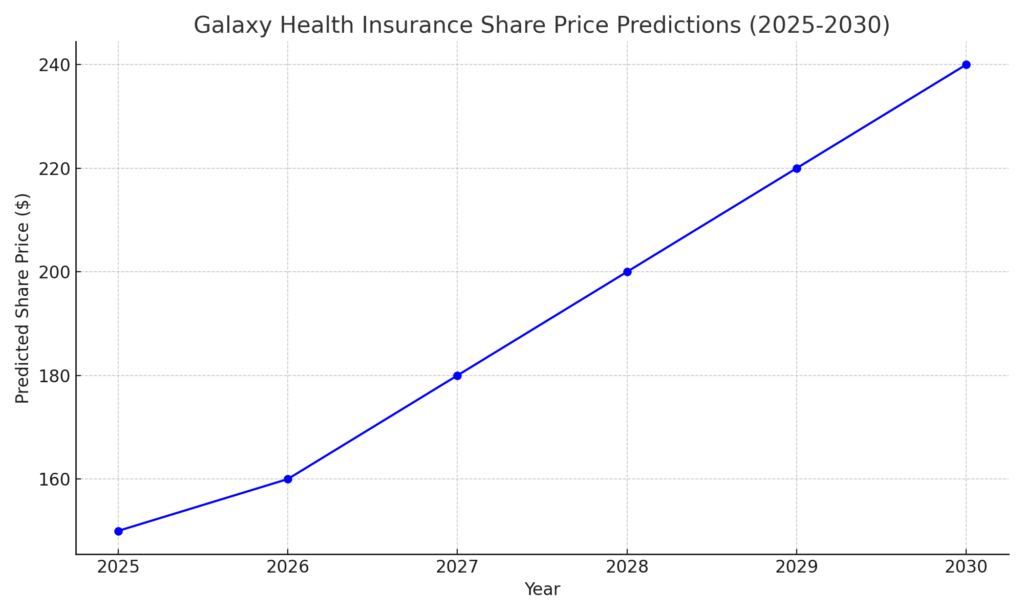

While precise share price predictions can be challenging due to market volatility and unforeseen events, several analyses indicate a positive outlook for Galaxy Health Insurance:

- 2025 Target: Analysts predict that if Galaxy Health Insurance maintains its growth trajectory, the share price could reach between ₹300 and ₹350 by 2025. This prediction hinges on the company successfully expanding its customer base and rolling out new insurance products that resonate with consumers.

- 2030 Target: Looking further ahead, the share price could potentially climb to ₹500 or even higher by 2030, assuming sustained revenue growth and effective cost management. This optimistic outlook is based on projected increases in the overall insurance market size in India, which could more than double by 2030.

Conclusion

Galaxy Health Insurance’s overall plan of the next few years particularly the share price target in 2025 to 2030 will definitely be bloated with the extent of growth within the Indian health insurance market. Thus, the company can enrich its market position by paying attention to innovative products, developing technological supplying of customer services, and optimizing the regulation achievements.

As with all the potential investment opportunities, the interested investors should undertake their research and due diligence as well as to focus on such aspects as the state of the general market, performance of the particular company, as well as the leading economical indicators. It will be advisable to pay attention to the company’s production and operating results on a quarterly basis and overall trends in the industry.

For more information about the current performance and insights into the company’s future, you can visit resources like Galaxy Health Insurance’s official website and financial analysis platforms that track the stock market.